Table of Contents

How to Write a Cheque

Here we are talking about How to write a cheque. While less common than they once were, cheques are still widely used, even in today’s digital world. Paper cheques are a useful and inexpensive tool for moving money, but you probably don’t write a statement every day (or maybe you’ve never done it before).

Writing a cheque is easy, and this tutorial shows you exactly how to do it. Move through each step one-by-one, or use the example above as a model for the cheques you need to write. You can complete the steps in any order you like as long as the finished product isn’t missing any vital information. In this example, you’ll move from the top of a cheque to the bottom, which should help you avoid skipping any steps. XBOX GOLD GAMES

Online money management, mobile banking, and digital payments are standard in the financial world. However, there are still situations when you may need to resort to old fashioned means of handling money – enter cheques. But don’t be intimidated. Cheques are simpler to fill out than they look.

What are the main elements of a Write a Cheque ?

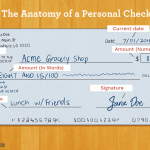

In this article, we will look at how to write a cheque correctly and safely. To help us we will consider a cheque, and I recommend you to have your cheque in your hand so you can easily understand what the article says. The main thing to remember is that there are about six elements to remember that you need to fill in when you are filing a cheque, and we will discuss them in detail one by one in this article. The main elements we will discuss in this article are almost, more or less, the same in most countries. Even if your country’s cheque looks slightly different from this, then do not worry, it is okay as you will almost have to fill in the same information, so let us look at these parts. The six pieces of information you need to fill in on a cheque are

- The first one is the date. That is almost the same and common element all around the world. Now the data can be written in different ways in different parts of the world. Sometimes in some parts of the world, an international standard has been established, where you have to write the year first, then the month and then the day. According to that format, the year would be 2020, and the month would be seventh, and the day will be seven as per this article writing date. However, sometimes to let you know that that’s how they want you to mention the date in the date section, you might see lightly written over some of the following sequences.

YYYY/MM/DD, DD/MM/YYYY, and MM/DD/YYYY

Whenever you see something like the formats mentioned above on a cheque or any other form, remember what each letter represents here. Y stands for year, and YYYY means that they want you to write the full paper of year there, like 2020, and M stands for month, and MM means complete digit of the month, like 07, and DD represents a day of the day like 07. You can also write the date as July 7, 2020. When you write the date in this format, do not forget to put a comma between day and year.

Write a Cheque Name of a Person or Representation of a Business

- The next thing is who we are going to write this cheque to. We write the name of a person or representation of a business. The owner of the cheque is mentioned by default on the top of the cheque. However, to whom a cheque is written is always mentioned in the space given. That is a one to multi relationship in the database if someone understands the data base. Write the name of the payee with correct spelling.

- Now comes the essential part of any cheque, which is common in every cheque, that is the amount section. In this part of the cheque, the amount of a cheque comes in numbers. The most important thing to remember while going for this part is writing the first number right against the box’s size when you write the amount in this section. If you leave space on the left, you allow somebody to add a number before the number you entered. In this way, you can be cheated easily, and that would all be your fault, not theirs. So make sure that you do not allow this to happen. On the right side of the number, someone might cheat you on that side of the number. Do not worry, as we can also stop this from happening by drawing a slash and dash, representing only. These are the precautions, and you might have some specific style in your country.

Amount in Words

- The next part is the amount in words. This part confirms because sometimes people do not write their numbers clearly, and the cashier gets confused. It is like you are asked by any software to verify your password before moving further. This part clarifies to the bank that the amount you have written in numbers is the required amount. Start from the very right side, leaving no space for someone to put a word or there. Similarly, put a line at the end of cheque words, or you can write “only,” so no one can set its terms there.

-

Crucial Part of Cheque

- We come to the next crucial part of a cheque, which is almost the same in every country: the signature section. Your bank has your signatures at the time of opening the account, so this is the way that your bank knows that you issue this cheque. See your signatures at the end of the cheque, mostly. If you want to face no problems in this section, you should have constant signatures, so the bank does not bother you when they match your signature. You don’t need to sign your cheque in English. And You can go any way you want. Then You can sign your cheque in any language because sometimes people have their signatures in their speeches. That is perfectly fine, and you do not have to sign in English. You do not face any problem as long as you put the same signature recorded in the bank.

- To sum up, the English version of your signature is not essential to be produced. Some other things on your cheque are your bank’s name, some coding numbers, routing numbers, or your account number. These things can be anywhere on the cheque, different from bank to bank. You do not mess with these things as they are printed on your cheque already. You are not required to do anything to them.

- Sometimes there is a little space on the cheque under the heading “memo.” You might want to fill out this memo section to remember what purpose was that cheque for. It is like a little note to yourself. This section reminds you of what that cheque was aimed for like it could be “for car repair” or anything else.

Above six are the essential and most essential elements that are almost the same worldwide, and in the somehow different sequence, every cheque needs these elements to be filled in.

Write a Cheque Some safety precautions so that you do not make mistakes and blunders

Let me now give you a few other safety precautions so that nobody else can do something illegal to your cheque. So one way to avoid mistakes, or to avoid anybody doing something fraudulent with your cheque is to use CAPITAL letters because it is harder to change capital letters, so that is often advised by the bank to fill in the information in capital letters.

Start writing your numbers at the far left, as explained above, with the reasons and risks involved in leaving space left or right to your numbers or your words. Leaving no room at the left and right side of the digits makes your cheque safe, and nobody can alter the existing information or add something extra to your cheque.

Matching Signature

Also, make sure to sign consistently and always use the same signature. Whatever that signature is, it does not matter. It only needs to be in matching with the registered signature of yours.

Okay, this might be seen prominent that do not ever sign a blank cheque. I mean that sometimes you might not know the business’s name or the person you will give a cheque to. You sign a cheque and put it in your pocket and decide to fill it when you get there. That is a hazardous way as you know that you can lose your blank signed cheque, and anyone can fill it and cash it as much amount as he wants. To avoid this, only sign a cheque after filling it with the payee name and the amount specified on it with the precautions mentioned above.

Do not ever write to cash while withdrawing money. Instead, write your name because if you lose the cheque, anyone can cash it and get your money out of your account.

Before we end, two small points always write 40 in words as forty, not forty, as many people do make this mistake; therefore, I thought I should clear this too for your benefit and ease. Make sure you have written the words against your numbers correctly, as people mostly make mistakes here. That is all about writing a cheque and some safety measures to be taken while filling a cheque.

What is next:

After you write the cheque, make a record of the payment. A cheque register is an ideal place to do this, whether you use an electronic or paper register. Recording the price prevents you from spending the money twice—the funds will still show as available in your account until after the cheque is deposited or cashed, and that could take a while. It’s best to make a note of the payment while it’s fresh in your mind.

Before writing a cheque

make sure that it’s something you need to do. Writing a statement is cumbersome, and it’s not the fastest way to move money. You might have other options that make your life easier and help you save money. For example, you can:

Pay bills online, and even tell your bank to send a cheque automatically each month. You won’t need to write the review, pay for postage, or get the statement in the mail

Get a debit card and spend with that instead. You’ll payout of the same account, but you’ll do it electronically. There’s no need to use up cheques (which you’ll have to re-order), and you’ll have an electronic record of your transaction with the payee name, the date of your payment, and the amount.

Set-Up Automatic Payments

Set up automatic payments for regular payments like utility bills and insurance premiums. There’s typically no charge to pay this way, and it makes your life easy. Just be sure that you’ve always got enough cash in your account to cover the bill.2

No matter how you choose to pay, make sure you always have sufficient funds available in your checking account. If you don’t, your payments may “bounce” and create problems, including hefty fees and potential legal issues.

Tear off the cheque, and keep a record for yourself. If you’re using an old school carbon-copy checkbook, tear off the cheque’s full copy to give to your recipient. The second, lighter reproduction, is yours to keep.

If your checkbook doesn’t come with carbon copies, make sure you fill out a cheque register with the transaction details. Your checkbook may come with a blank record at the front or back of it or may even include stubs attached to each cheque that remain in the book after the cheques are torn out. If this isn’t the case, you can buy a register separately.

How to void a cheque

If you wrote the wrong amount on a cheque or are giving someone a cheque to verify your bank account information, it’s essential to make sure that no one can cash the cheque and take money out of your account. That can be done by writing VOID across the cheque. Be sure to write in clear, large letters, covering all the primary fields of the cheque.

How to write a cheque to yourself

If you want to move money from one account to another, you can write a cheque to yourself by putting your name in the “Pay to the order of” field. Before depositing the cheque, you’ll have to endorse it by putting your signature in the appropriate area on the backside of the cheque.

What if I make a mistake while writing a cheque?

Although there’s a possibility that the bank may reject your cheque, most of the time, this can be avoided by (1) crossing out the error with a single, horizontal line, (2) writing the correct information above it, and (3) initialing the change to indicate your approval.

Some mistakes, like writing out the wrong amount on the line, might be considered more consequential than others, and an initialed correction probably won’t be enough. In such cases, you’re probably better off voiding the cheque and writing a new one.

How to write a cheque out to cash

Cheques are generally safer than cash because only the payee can cash the cheque. But when you write a cheque out to money, anyone can receive the funds — whether you want them to or not. For this reason, it’s usually not advisable to write a cheque out to cash.

But if you find yourself in a pinch and need to write a cheque out to cash, here’s how you do it:

- Fill in today’s date in the top right corner of the cheque.

- Write cash in the Pay to The Order Of section.

- Fill in the dollar amount next to the $ symbol.

- Write out the dollar amount in words on the blank line under the Pay To The Order Of section.

- Add a note in the Memo section if you want to note why you’re taking out cash.

- Write your signature on the blank line in the bottom right corner of the cheque.

Security Tips:

Develop the habits below to decrease the chances of fraud hitting your account.

- Make it permanent: Use a pen whenever you write a cheque. If you use a pencil, anybody with an eraser can change the amount of your cheque and the name of the payee.

- No blank cheques: Don’t sign a statement until after you’ve filled in the name of the payee and the amount. If you’re not sure who to make the cheque payable or how much something costs, bring a pen—it’s much less risky than giving somebody unlimited access to your checking account.

-

Keep cheques from growing:

- When you’re filling in the dollar amount, make sure you print the value in a way that prevents scammers from adding to it. Do this by starting at the far-left edge of the space, and draw a line after the last digit. For example, if your cheque is for $8.15, the “8” is as far to the left as possible. Then, draw a line from the right side of the “5” to the end of the space or write the numbers so large that it’s hard to add any numbers. If you leave the room, somebody can add digits, and your cheque might end up being $98.15 or $8,159.

Carbon copies:

- If you want a paper record of every cheque you write, get checkbooks with carbon copies. Those checkbooks feature a thin sheet containing a copy of every cheque you write. As a result, you can quickly identify where your money went and exactly what you wrote on every cheque.

Consistent signature:

- Many people don’t have a legible signature, and some even sign cheques and credit card slip with humorous images. But consistently using the same signature helps you and your bank identify fraud. It’ll be easier for you to prove that you’re not responsible for charges if a signature doesn’t match.

No “Cash”:

- Avoid writing a cheque payable to cash. That is just as risky as carrying around a signed blank cheque or a wad of money.3 If you need cash, withdraw from an ATM, buy a stick of gum, get some money back using your debit card, or get some money from a teller.

-

Write fewer cheques:

- Cheques aren’t exactly risky, but there are safer ways to pay for things. When you make electronic payments, there’s no paper to get lost or stolen. Most cheques get converted to an electronic amount anyway, so you’re not avoiding technology by using cheques. Electronic payments are typically easier to track because they’re already in a searchable format with a timestamp and the payee’s name. Use tools like online bill payment for your recurring expenses, and use a credit or debit card for everyday spending.

What do the numbers on a cheque mean?

The numbers on a cheque are like a roadmap to your account. That allows the recipient to “find” your money and withdraw the amount specified on the cheque. Technically, though, all the recipient does is deposit the cheque at his or her bank – the rest is done electronically through Canada’s clearinghouse and settlement systems.

- The cheque number reflects the checkbook’s cheque sequence (the first cheque will be 001, the second will be 002, etc.).

- The transit number is used to identify your bank branch, likely the specific location you opened the account. That is like the 9-digit routing number used by US banks, though transit and routing numbers cannot be used interchangeably. Online banks that don’t have any physical branches may provide all their customers with the same transit number to avoid confusion.

- The institution number (also called the bank number) identifies your financial institution.

- The account number identifies your specific account.

Record the Payment in your Cheque Register:

Make a record of every cheque you write in a cheque register. Doing so will allow you to:

- Track your spending so you don’t bounce cheques.

- Know where your money goes. Your bank statement may only show a cheque number and amount—with no description of who you wrote the cheque to.

- Detect fraud and identity theft in your checking account.

You should have received a cheque register when you got your checkbook. If you don’t have one, it’s easy to make your own using paper or a spreadsheet. Why Does My Tablet Freeze When Playing Games?

Copy all of the essential information from your cheque:

- The cheque numbers

- The date that you wrote the cheque

- A description of the transaction or who you wrote the cheque to

- How much the payment was for

If you need more details on finding this information, see a diagram showing the different cheque parts.

You can use your register to balance your checking account. That is the practice of double-checking every transaction in your bank account to ensure you and the bank are on the same page. You’ll know if there are mistakes in your account, and if anybody has failed to deposit a cheque, you wrote them (thereby making you believe you have more money to spend).

Your cheque register can also provide an instant view of how much money you have available. Once you write a cheque, you should assume that the money is gone—in some cases, the funds are drawn from your account quickly because your cheque is converted to an electronic cheque.

General pointers:

Here are some essential general pointers on how to write a cheque. In addition to the six steps above, you’ll also want to consider these points carefully:

- Write as neatly as you can.

- Use printing instead of cursive, if possible. For purposes of clarity – it is easier to read print than it is to read the script.

- If you make an error, write “void” on the cheque and start writing a new one,

- Ensure all spellings are correct.

- Double-cheque that you have the right recipient and the correct value amount,

Additional resources

Thank you for reading this guide on how to write a cheque. CFI is a global provider of extensive training and career advancement for financial professionals. To learn more and advance your career, explore the additional relevant CFI resources below: